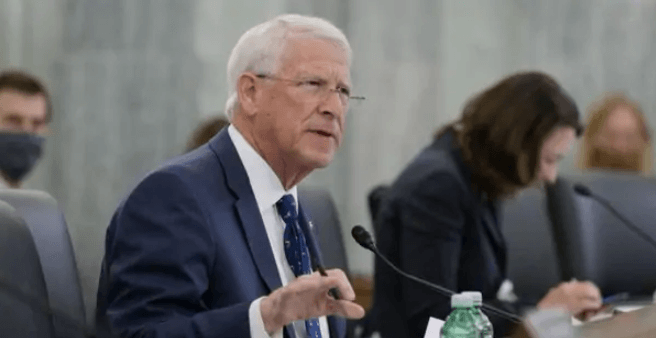

Wicker: Biden burdens the American economy

Tax-and-Spend Policies Hold Us Back

As President Biden reflects on his administration’s record, his White House spokesmen are working overtime to rehabilitate his economic message. They have seized the term “Bidenomics” and are attempting to define it in a positive light.

He will struggle to find an audience who agrees. Six in ten Americans disapprove of the president’s handling of the economy. His policies have raised prices and restrained growth, but he would have the nation believe otherwise. Like the fabled Rumpelstiltskin, he hopes to spin straw into gold and persuade the American people that his misguided agenda has actually been good for their pocketbooks.

Bidenomics Drags On the Economy

When he took office, the president inherited an economy making a strong recovery from the pandemic. He promptly poured cold water on that progress with a $1.9 trillion partisan spending bill. On cue, inflation soared and wage gains evaporated. His policies incentivized Americans to stay home, delaying full recovery. Congressional Democrats even used obscure Senate rules to pass the absurdly-named “Inflation Reduction Act.” It did not easeb the pain. Instead, inflation ultimately peaked at 9 percent.

Last year’s midterms brought a Republican majority to the House of Representatives. This has blocked further spending sprees. But last month, the Bureau of Labor Statistics revealed that Americans still bear the effects of the president’s inflation.

Since the start of this administration, the price of regular purchases has risen sharply. A gallon of gas is $1.20 more expensive, rent is up 15 percent, and grocery bills are 20 percent higher. Big-ticket items also pack more punch. Furniture is 19 percent costlier. Airfare is significantly more expensive (49 percent). New vehicles cost 20 percent more, which drives up the price of used vehicles, too (33 percent). Higher interest rates are making it harder for Americans to own a home. In the week of July 13th, average mortgage rates ticked up from 6.81 percent to 6.96 percent.

These price increases have a snowball effect. Little by little, they have eroded household wealth. Americans are saving half as much as they were before the pandemic and are now saddled with record credit card debt. This hits lower-income workers the hardest, hampering their ability to build savings. Like many of the president’s missteps, this economic pain was self-inflicted.

American Workers Move to Red States

By resisting the urge to spend, the president could have nurtured an economy that was already poised to emerge out of lockdown. He could have actually built back better by encouraging Americans to get back to work. Meanwhile, in states across the country, Republicans are providing a glimpse of what the Biden administration could have achieved nationwide.

Conservative leaders have lowered taxes and reformed permitting, making their states more affordable for residents and job creators. Consequently, Americans are leaving California and New York and heading south. Mississippi’s pro-growth policies are proving this by attracting investment and stimulating the entire market. Last year, the state drew $6 billion in new capital. And since 2019, per capita income for Mississippians has risen by nearly $8,700.

Instead of bringing these policies to the nation, President Biden led us into the worst inflation since the Carter administration. And by embracing the “Bidenomics” label, he exposes himself to the same criticism Ronald Reagan leveled at Jimmy Carter. In a moment that may have changed the course of the 1980 presidential race, then-candidate Reagan asked the American people, “Are you better off today than you were four years ago?” Many Americans today are asking the same question.

Note: This item is the weekly Wicker Report of U.S. Sen. Roger Wicker, and is provided by the Senator’s office.