Simmons expresses opposition to tax cut plan

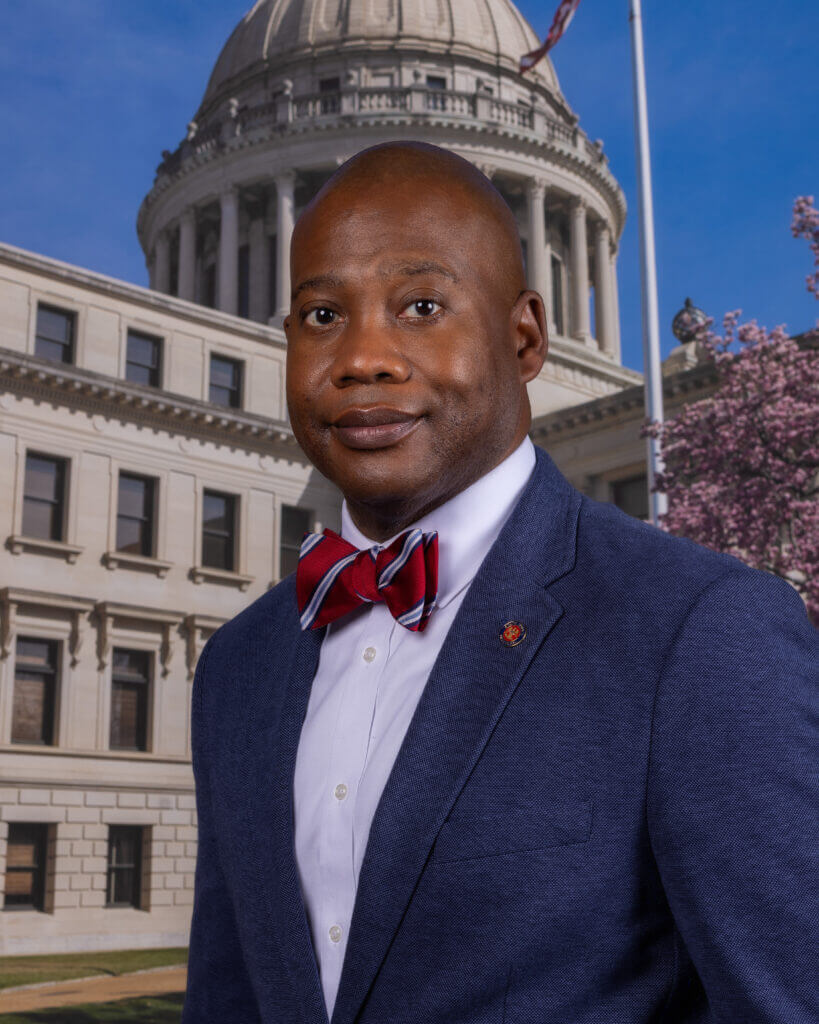

Photo: Senate Minority Leader Sen. Derrick T. Simmons (D-Greenville).

Mar 3, 2025- Current efforts to cut taxes being considered in the Mississippi Legislature are getting opposition from the Senate Minority Leader.

Sen. Derrick T. Simmons (D-Greenville) said Monday he has concerns that primarily focus on the potential impact of these measures on working-class Mississippians and state revenues.

Sen. Simmons has voiced objections to the proposed increase in the gasoline tax included in the Senate’s tax cut bill, Senate Bill 3095, which has passed the Senate and is now being considered in the House of Representatives.

The bill proposes increasing the gasoline tax by nine cents per gallon over three years to fund road and bridge maintenance. Sen. Simmons argues that raising the gasoline tax would disproportionately affect rural Mississippians. He believes that lawmakers should focus on making necessary investments in infrastructure without further reducing state revenues.

Simmons has advocated for the complete elimination of the state’s grocery tax, which currently is the highest grocery tax in the nation among the 12 states that tax groceries. Sen. Simmons proposed an amendment to fully eliminate the grocery tax, arguing that such a move would benefit all Mississippians and align the state with the 33 other states and Washington, D.C., that do not tax groceries. He suggested adjusting tax diversions to municipalities to avoid any loss to cities, emphasizing that reducing the grocery tax to zero would allow Mississippians to purchase necessary food items for their families without the added tax burden.

The bill aims to reduce the state income tax from 4 percent to 2.99 percent by 2030 and cut the sales tax on groceries from 7 percent to 5 percent starting in July 2026.

Simmons said he advocates for a more comprehensive approach that includes the complete elimination of the grocery tax and careful consideration of the state’s revenue needs to ensure the proper funding of essential services.