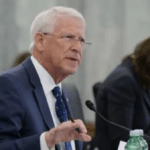

Chaney: mitigation program would save money, property and lives

Note: The following is an opinion-editorial article provided by Mississippi Insurance Commissioner Mike Chaney. The opinions may not necessarily be those of this publication.

By Mississippi Insurance Commissioner Mike Chaney

One of the top complaints I receive as Commissioner of Insurance is regarding the rate increases policyholders are seeing in this difficult market. I am certainly sympathetic to this, as I have seen rate increases on my own property as well. Inflation and supply chain issues have affected the cost of goods around the world and right here in Mississippi. Most insurers I talk to are seeking rate relief due to the cost associated with repairing and rebuilding non-fortified homes in addition to reinsurance costs.

We now have an opportunity to do something positive and offer some relief to the policyholders of this State. Legislation has been introduced that would create the Hurricane and Wind Mitigation Program, which would provide a statewide mitigation program within the Mississippi Insurance Department (MID), as all Mississippians have the potential to be impacted by hurricanes, high winds and tornadoes.

Mitigation efforts can include building at a higher elevation, adding hurricane shutters, fastening your roof to the walls with hurricane straps and buying flood insurance, among other efforts. For every one dollar spent on mitigation, the average payback on the investment happens within 2.7 years. Mitigation makes communities more resilient following catastrophic events as it can lessen loss severity and allow homeowners to get back on their feet quicker. Research shows that fortified roofs reduce insurer loss severity by as much as 60 percent. Mississippi state law requires insurance companies to give discounts to people who mitigate their home to the Insurance Institute for Business and Home Safety (IBHS) standards, and insurers have filed discounts with MID ranging from 15 percent to 30 percent for those fortified homes.

Research from IBHS shows that investing a few hundred extra dollars, when replacing your roof, can save you thousands in damage later. However, not everyone has a few hundred dollars lying around to spend on mitigating your home as sometimes more pressing expenses take precedent. If passed, the new law would create the Mississippi Comprehensive Hurricane and Wind Damage Mitigation Program Trust Fund. The Trust Fund would be funded by diverting a current assessment on property and casualty insurance companies. The legislation would also allow MID to apply for public and private grants to mitigate Mississippi homes, thereby allowing this assessment to directly help Mississippians. MID currently mandates that discounts be available for mitigation; therefore, housing the mitigation program within MID will allow my staff to ensure that complaints are handled properly and that insurance companies are providing the appropriate premium discounts for fortified homes without adding an additional layer of bureaucracy or incurring unnecessary administrative costs.

When Hurricane Sally struck the Alabama coast in September 2020, the slow-moving storm unleashed maximum sustained winds of 105 mph, leading to extensive roof damage from southern Alabama to northwestern Florida. Reports from IBHS show that more than 17,000 homes built or upgraded to the FORTIFIED standard were threatened by the storm and 95 percent of those houses incurred little or no storm-related damage. We saw the benefits of mitigation and stronger roofs again following Hurricanes Matthew (2016), Florence (2018), Dorian (2019), and Isaias (2020). If the resident with the FORTIFIED roof did experience a claim, the claim resulted in 22 percent less damage.

FORTIFIED Roof grants are available in Alabama, North Carolina, South Carolina and Louisiana. Strengthen Alabama Homes, operated by the Alabama Department of Insurance, has issued over 5,000 grants of up to $10,000 each. Our neighbors in Louisiana launched their program last fall. Since that time, the Louisiana Department of Insurance has awarded approximately 2,500 grants of up to $10,000 each.

It’s important to note that the frequency and severity of natural disasters plays a large part in rate increases. The proposed mitigation program will be statewide and not just for the coastal counties. Tornadoes pose a threat to our entire state and current models show us that tornadoes, as well as hurricanes, are increasing. Mississippi saw 61 tornadoes in 2023 – a sharp drop from 120 in 2022 but it still puts our state in one of the top spots for number of tornadoes each year.

Because of hurricane and wind threats, Mississippi is among the top ten most expensive states for homeowners’ insurance with an average premium greater than $1,500 per year. Premiums are also higher in Mississippi’s Coastal counties compared to inland counties. Jackson County had the highest annual premium at nearly $2,000 in 2020.

Over the years, weather has changed, risks have changed, and insurance is changing. I hope that the legislature will see the need for a viable mitigation program as well. Setting higher building standards and offering incentives for mitigation will save lives, property and money. Mitigation gives consumers greater confidence in purchasing a home and lowers insurance costs. Every family deserves to live in a strong home built to withstand the severe weather it faces and everyone should have access to affordable, reliable insurance.