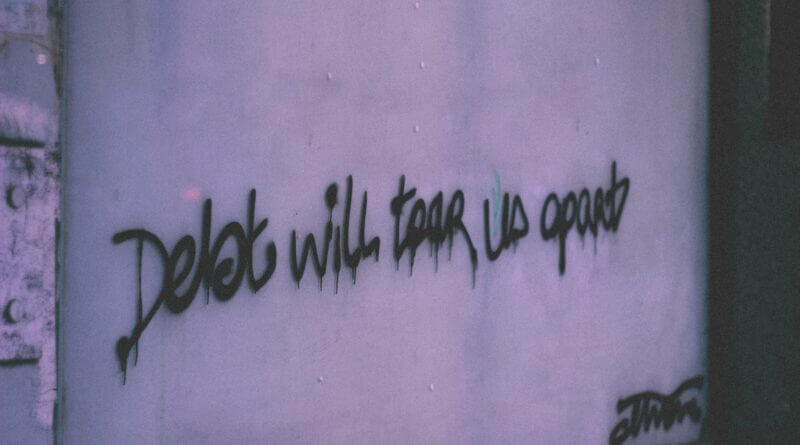

Harris: Changing a few habits can lead to getting out of debt

By Charlestien Harris

For most people, change is never easy. But if the effort is made, it can lead to positive results in improving your finances.

Contrary to what you might think, it is never too late to start making changes in your personal finances that will lead to success. Making a few minor changes in your current habits can lead to rewarding results, like getting out of debt. If this is one of your financial goals for 2024, you have come to the right place to get some guidance on how to get on the right track to reach your goal of getting out of debt. I want to encourage you that all is not lost, and you can avoid repeating some of your previous financial habits by making some small changes in the way you handle your debt.

Let’s take a look at some ways you can make changes to your habits when it comes to reducing your current debt.

Habit Change #1 – Not knowing how much debt you are currently in.

In order to get out of debt, you must know how much debt you currently have. Most people have a variety of debt, ranging from credit cards, auto loans, medical debt, student loan debt, personal loans, and a mortgage, or more. As time passes, it can be hard to keep track of it all. Knowing how much debt you owe is the first important step in getting a handle on paying it off, especially if you are behind in payments or have debt in collections. Begin the practice of keeping a running total of what you owe and to whom. This simple habit change will help you gain control and come up with a strategy to eliminate the debt.

Habit Change #2 – Not submitting more than the minimum payment.

Changing this habit can really go a long way in making a dent in the amount of debt you owe if you begin to pay more than the minimum payment amount due. You will incur less interest, number one! Every dollar you pay over the minimum reduces your actual debt, which reduces the amount of interest charged. So even if you can’t pay off your balance in full, it’s to your benefit to pay more than the minimum. If you pay more than your minimum payment on a card, your issuer is required to apply any money in excess of the credit card minimum payment to the balance with the highest APR and any remaining portion to the other balances in descending order based on the APR.

Habit Change #3 – Not making adjustments to your budget to avoid creating additional debt.

This one habit change can really make a difference if you discipline yourself by streamlining your spending habits. Most likely, last year you didn’t use a budget or you were flexible with your financial planning. Why not take this year to create a detailed financial plan? Planning your finances makes it easier to designate funds toward your needs and goals. A spending plan will also give you an opportunity to plan for unexpected emergency situations. Knowing how and where your money is going will give you a greater sense of financial security. The more detailed and comprehensive your plan is, the more financially sound you can become. A monthly budget is one of the most common and popular forms of financial planning.

Habit Change #4 – Not acting when you realize you are struggling financially.

As a counselor, I see this habit quite frequently. People more often than not choose to ignore the notices or phone calls they receive from a creditor or debt collector, hoping that it will just “go away.” One key way to improve your finances is to make a new habit of acting when you notice there could be a potential problem. I know it can get overwhelming sometimes, and when that happens, it is good to act as soon as possible. You are not alone because a lot of people are struggling with debt, so creating a budget will get you on the right track to reaching your goal of getting out of debt. The most important thing is to act and make a change when you begin to struggle or are struggling to meet your financial obligations.

Habit Change #5 – Not starting a savings account or an emergency fund.

Not having a savings account or an emergency fund is one of the most essential parts of handling your finances successfully. If you don’t have one, it can lead to financial problems. Saving money is one of the ways you can protect yourself against financial instability and ruin. A savings plan should include a fund for emergencies and one for retirement. An emergency fund will be your short-term savings fund. It can also be used for temporary or immediate financial help, like loss of employment, unexpected medical expenses, etc. Your retirement fund will be your long-term savings plan. A good way to begin to change your habit is to start each savings fund by opening an individual account for each. Try keeping them separate because that will help prevent overlap spending and will be easier to track.

Habit Change #6 – Not tracking your spending habits on a regular basis.

I know I have mentioned this many times before, but it is so important to add this habit to your list of changes. In order to realize how to get out of debt, you must be able to recognize the problems first. Improving your finances can be as simple as tracking your spending habits. You can track your spending by writing down each expenditure in detail down to the cent or balancing your checking account on a weekly basis. It’s important to have a consistent method of tracking your spending habits — daily, weekly, or monthly will be the best way to become aware of how you spend your funds.

Many people who are having a tough time with their personal finances try to handle the situation on their own. Seeking professional help when your financial situation gets overwhelming at times is also a great habit change that can help you develop a plan to get out of debt. HUD-certified counselors are trained professionals who can help you develop that plan. Southern Bancorp has four HUD-certified housing counselors on staff to help you get back on track. If you don’t live near a branch, you can visit HUD Counseling to search for a counselor online. Most times, seeking professional help for a financial issue outside of your knowledge can be extremely beneficial.

In this new year of 2024, you can achieve the goal you set of getting out of debt. Instead of repeating the same financial pattern that you’ve followed in the past, take this time to break out of your bad habits and improve your finances.

For additional information on this and other financial topics, visit our blog at banksouthern.com/blog, email me at Charlestien.Harris@banksouthern.com, or call me at 662-624-5776.

Until next week – stay financially fit!

Charlestien Harris is a financial contributor and a financial expert with Southern Bancorp Community Partners whose articles are seen in a number of publications around the region.